kelly criterion excel|kelly criterion pdf : Baguio We’ve developed a Kelly Criterion formula Excel spreadsheet that you can download here. It’s free and easy to use. Simply input your betting bankroll, the odds on offer, your assessed probability for that outcome occurring and your Kelly fraction. Tingnan ang higit pa Rome2Rio makes travelling from Manila to Santa Cruz, Zambales easy. Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Manila to Santa Cruz, Zambales right here. Rome2Rio displays up to date schedules, route maps, journey .

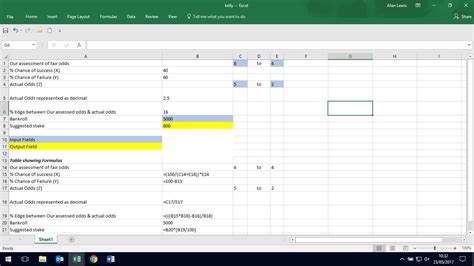

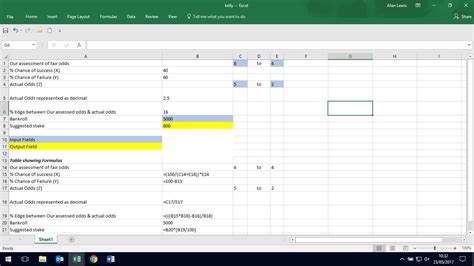

kelly criterion excel,We’ve developed a Kelly Criterion formula Excel spreadsheet that you can download here. It’s free and easy to use. Simply input your betting bankroll, the odds on offer, your assessed probability for that outcome occurring and your Kelly fraction. Tingnan ang higit paOpen a new Excel spreadsheet and create the following headers: Betting Bankroll, Kelly Staking Fraction, 1 (outcome 1), 2 (outcome 2), Odds 1, Odds 2, . Tingnan ang higit paNow we get down to the serious business. In cell I2 add the following formula: =((((E2*G2)-1)/(E2-1))*A2)*B2 In this case. E2 = odds for outcome 1 G2 = your assessed . Tingnan ang higit pa

Enter both your current betting bankroll and your preferred Kelly staking fraction into the cells accordingly. Tingnan ang higit paNext enter the two possible outcomes for this market and the odds on offer for each outcome. In this example we are betting on the Asian Handicap in a Premier League . Tingnan ang higit pa Position Sizing can make or break your trading results. Use the Kelly Criterion to identify the mathematical optimum amount of capital which you should allocate to any given trade (or even a . I therefore recommend using the more sophisticated generalised Kelly Criterion wherever possible as it is superior to the simplified Kelly Criterion. The Real . Download our free and easy-to-use Kelly Criterion Calculator by downloading this excel file! All you need to do is choose which column you want to use .kelly criterion excel The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses. The method is based on a mathematical formula designed to enhance .

What is the Kelly Criterion? Kelly criterion is a mathematical formula for bet sizing, which is frequently used by investors to decide how much money they should allocate to each . Kelly’s strategy, also known as the Kelly Criterion, is a bank management strategy specifically designed for sports betting, including football. It helps determine the .

This article will explain usage of an excel implementation applying the Real Kelly Criterion to concurrent events. In detail the algorithm will find optimal bet sizes for a set of concurrent singles . Learn how to use the Kelly Criterion, a mathematical formula that helps investors and gamblers calculate the optimal size of their positions. Find out the history, steps, advantages and .

The Kelly Criterion is a famous formula developed by its name-sake John Kelly Jr and is used by many a handicapper and blackjack player. It is an effective way to manage your . The Kelly criterion calculates the portion of your funds to place on a wager. The calculator will multiply this number by the account balance you specify to yield a recommended stake. Do not include any currency symbols. Minimum accepted stake. Input the minimum accepted stake that your betting exchange permits. E.g.If everytime we trade we force ourselves to trade 2.5 to 1 come hell or high water one thousand times we should *expect* make on average: $12,000.00Introduction. This article explores the Kelly Criterion and its application in options trading. Key Takeaways: Kelly Criterion Basics: A mathematical formula for optimal position sizing, balancing risk and reward.; Practical Application: Utilize trading history to estimate inputs for the formula.; Risk Management: Advises on the proportion of capital to invest, aiding in .

拉里拉里

Kelly Criterion Excel Spreadsheet. Excel is an extremely powerful program that can be used for various betting related situations and none more so than calculating the Kelly criterion. It is possible to come up with Excel spreadsheets that do all the calculations in order to find out if a potential bet is viable under the Kelly criterion strategy. The Kelly Criterion is a mathematical formula that helps investors and gamblers calculate what percentage of their money they should allocate to each investment or bet. The Kelly Criterion was .kelly criterion pdf The Kelly Criteria is an interesting thing to play with. Works quite well in many ways, but has serious limitations when used for trading. Works best when used in retrospect. One thing that complicates the matter is that short term results can vary widely from the long term. The Real Kelly – an #excel implementation for independent concurrent outcomes. In my previous articles we have already seen how the generalised Kelly Criterion can produce completely different results than the simplified Kelly formula that most bettors will use when there are multiple edges in the same game. There are, of .

How to use. Kelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments. Winning Probability : Enter the probability of earning a profit from investment. Gain of Positive Outcome : Enter the potential gain of a positive outcome. For example, if you invest 100 and get 10, the gain is 10%.

Has anyone made the Kelly Criterion Formula for excel? Here is the Formula: f*= (bp-q)/b. where. * f* is the fraction of the current bankroll to wager; * b is the odds received on the wager; * p is the probability of winning; * .Example of the optimal Kelly betting fraction, versus expected return of other fractional bets. In probability theory, the Kelly criterion (or Kelly strategy or Kelly bet) is a formula for sizing a bet. The Kelly bet size . The most popular methodology for determining the optimal wager size is the Kelly Criterion. It is a simple formula that calculates the proportion of your balance to wager on a particular gamble. The formula was derived by J.L. Kelly, Jr in 1956. The formula has a number of applications, one of which is sports betting. 1, 2.According to the Kelly criterion your optimal bet is about 5.71% of your capital, or $57.00. On 40.0% of similar occasions, you would expect to gain $99.75 in addition to your stake of $57.00 being returned. But on those occasions when you lose, you will lose your stake of $57.00. Your fortune will grow, on average, by about 0.28% on each bet. Twitter user @optibrebs recently made me aware of the generalised Kelly Criterion (a.k.a. The Real Kelly) discussed in this @Pinnacle article The Real Kelly. To be honest I have been successfully using the simple/naïve Kelly Criterion for years and haven’t bothered looking anywhere else. This is how the simplified Kelly looks. s = b * (o .Kelly Criterion. John Larry Kelly Jr. is the author of the Kelly criterion formula from 1956. It was found that the formula, which has a gambling background and helps to determine the optimal bet size, can also help with finding the ideal investment size. The Kelly bet size is found by maximizing the expected geometric growth rate. Re: Kelly Formula. If you have an 80% chance of winning $21 on a $1 bet, and 10% of winning $7.50, that's equivalent to having a 90% chance of winning $17.55, which is 18.55:1 expressed in bookie odds. So: You could add any number of other payoffs in like fashion. Last edited by shg; 07-26-2017 at 10:47 AM .

Step 1. Open a new Excel spreadsheet and create the following headers: Betting Bankroll, Kelly Staking Fraction, 1 (outcome 1), 2 (outcome 2), Odds 1, Odds 2, Probability of 1, Probability of 2, Kelly Stake 1 and Kelly Stake 2. Then click the centre align button to ensure all data is displayed in the centre of their cells.

kelly criterion excel|kelly criterion pdf

PH0 · kelly criterion pdf

PH1 · kelly criterion for bet sizing

PH2 · kelly criterion excel spreadsheet

PH3 · kelly criterion example

PH4 · kelly criterion calculator trading

PH5 · kelly criterion calculator excel download

PH6 · kelly criterion betting calculator

PH7 · how to calculate kelly criterion

PH8 · Iba pa